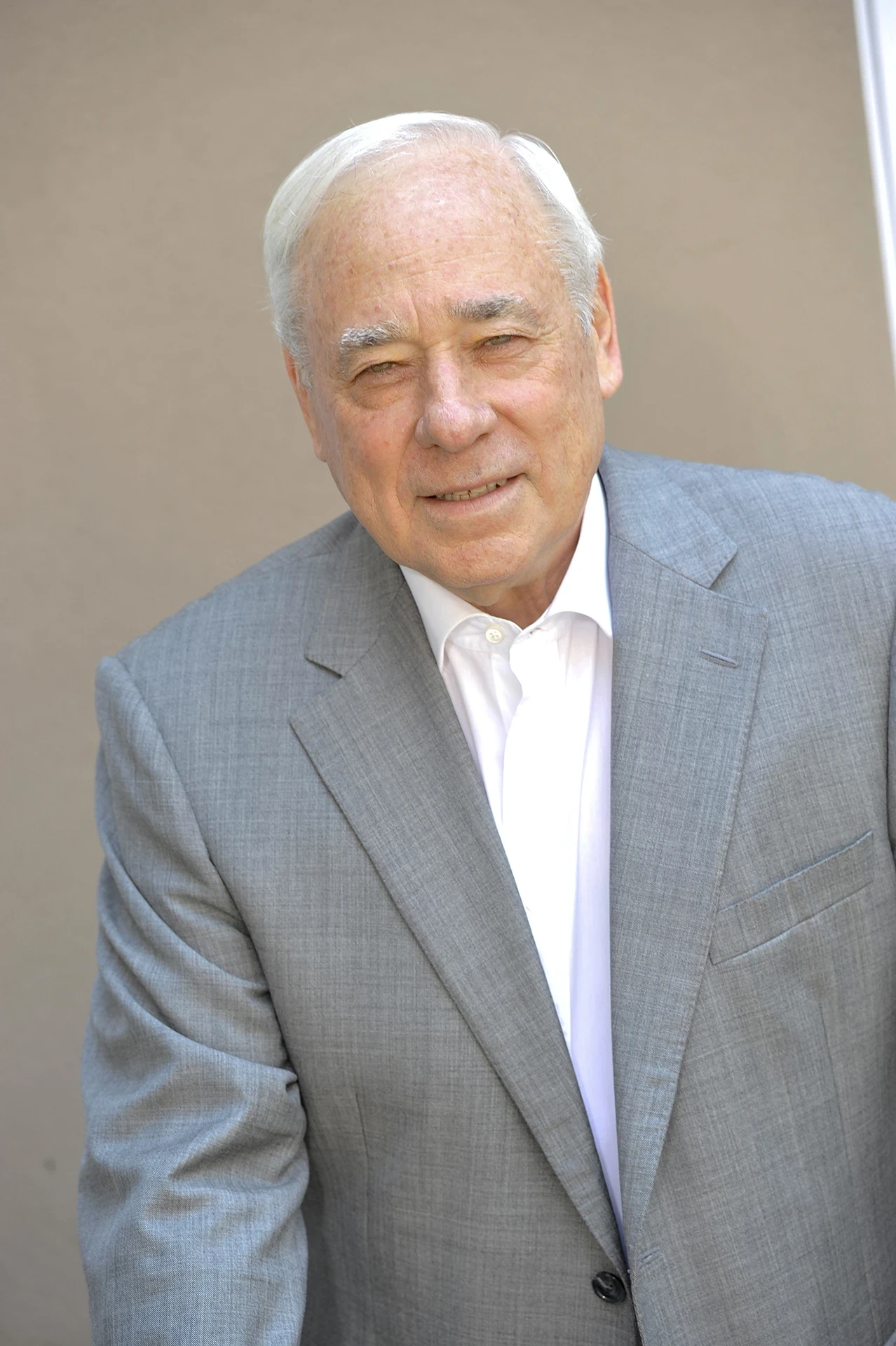

André Roux

André Roux

We are thrilled to announce a SAVCA first: a Lifetime Achievement Award bestowed upon André Roux, widely regarded as the pioneer and father/godfather/grandfather of private equity in South Africa.

Exactly 40 years ago, André Roux orchestrated the very first major management buyout in South Africa, acquiring Hudaco from its international parent company. This pivotal moment marked the genesis of private equity in our region, mirroring developments seen in established markets around the world.

Under his leadership, initially with FirstCorp and FNB, André later rebranded the independent private markets business as Ethos Private Equity. Throughout his tenure, he spearheaded numerous industry firsts and developed many leaders who themselves have left a mark across the industry, cementing his legacy as a driving force behind the growth and evolution of our industry.

After stepping down as Ethos CEO in 2014, André Roux continued to make invaluable contributions across various spheres and organisations within our sector.

SAVCA is thrilled to announce this inaugural award. Please view the video below to hear from other industry leaders and colleagues about the impact André has had.

André Roux Lifetime Achievement Award Highlight Reel

CELEBRATING THE LIFE AND LEGACY OF ANDRÉ ROUX, GRANDFATHER OF PRIVATE EQUITY

It is with great sadness that we must announce the passing of André Roux on Sunday, 7 April 2023. He was surrounded by his family and loved ones at his time of passing.

Paying tribute to a legend!

SAVCA wishes to pay tribute to the grandfather of Private Equity in the region, who has left an indelible mark in the industry. On behalf of the SAVCA board, management, and all employees, I extend heartfelt condolences to André’s family, friends, and many who worked closely with him over the 40 years that he invested in the growth of the private equity asset class in South Africa.

We are grateful that the industry came together at this year’s 2024 Private Equity Conference to pay homage to André for helping to shape many of our industry leaders and pioneering many firsts for South African private equity. These included the first MBO, some of the initial BEE transactions, raising the first 3rd party funds and catalysing international capital into local private equity.

André graduated with a Bachelor of Commerce degree from the University of the Witwatersrand, was a member of the South African Institute of Chartered Accountants and served on the board of what was then Emerging Markets Private Equity Association (now GPCA). Prior to the establishment of Ethos, André jointly held the positions of Chief Executive of FirstCorp Capital Investors Limited and FirstCorp Merchant Bank. He served on the boards of several portfolio companies associated with the various investment funds advised by Ethos and including Alexander Forbes.

André was the founding partner of Ethos, having established the business in 1984. As chief executive, he had overall responsibility for the firm’s strategic, operating and investment activities. As a result of this role, he was widely regarded as a pioneer in the private equity industry in South Africa. In 2014, he stepped down as Ethos CEO, and became Deputy Chairman and a member of the Investment Committee. He lectured extensively on the private equity industry to business schools, featured as a speaker at industry conferences and has participated in numerous industry-related symposia.

André is survived by his wife, Maureen; children, Paul, Jennifer and Phillipe, and his grandchildren.

Please join us in shining a light on the incredible impact Andre made, and celebrating the full life that André lived, by sharing heartwarming stories and words on this AR Roux Award site. Your stories of how Andre positively impacted on you as a leader and/or your organisation will keep his memory alive and help us harness the collective experiences and insights of leaders in this vibrant industry we serve.

Regards,

Vuyo Ntoi, SAVCA Chairman

Paul Boynton

Formerly CEO of Old Mutual Alternative Investments

"André was a seminal figure in the development of the private equity industry in South Africa. He was there at the beginning in the early 1980’s, played a massive role in the development of arguably the premier shop in town and had many folk graduate through the ranks at Firstcorp or Ethos who subsequently went on to write chapters of their own in the history-books of private equity in South Africa. The buyout of Hudaco from UK multinational, Blue Circle in the mid 1980’s was probably the first large leveraged buyout where André backed an LBO by a young Bruce MacInnes which was fabulously successful and also launched Bruce MacInnes on a serial career in buyouts in the UK.

André for me has always been someone who took time to engage. He has deep conversations and is insatiably curious. Always asking follow up questions at least one level deeper than others have gone. He has also been very generous in sharing his wisdom and being thoughtful about how you may approach opportunities or problems that he perceives may lie in front of you. Someone you relish spending time with because the interaction invariably enriches and often in ways that are unexpected.

When Old Mutual launched a life wrapped retail private equity product in mid 2000’s we started with a fund holding 3 managers, OM, Ethos and Brait. This was reasonably innovative stuff at the time trying to structure an illiquid investment for retail investment and in our discussions with André it was always surprising how much lateral thinking André had done. He exemplified the strategy of turning the box over in every conceivable way to ensure the optimal outcome but what also impressed was the thought given to ensuring it worked for everyone. An example for all of us as someone who has passionately developed the whole industry around them whilst also personally building an exceptional position within it.

I worked with André in various situations. Initially through Old Mutual being an investor in Ethos funds but also on various transactions where both Ethos and Old Mutual were invested."

Richard Stovin-Bradford

Former journalist at Business Report, Sunday Times Business Times and Lex columnist at the Financial Times, London.

"André Roux set a high bar for South Africa’s nascent private equity sector at First Corp Capital Investors, which was the country’s largest alternative capital provider at the time. Time flies: it started life in the First National Bank stable forty years ago. And when, in late 1998, André led its transformation into an independent, management-owned and operated business, relaunching it under the Ethos Private Equity banner, he raised that bar.

André had successfully reasoned with the Three Musketeers at FirstRand that operational independence was essential to running third-party investor funds - and desirable given the many advisory relationship overlaps in South Africa’s relatively shallow corporate advisory pool. He also clearly had a canny eye on the looming pipeline of company restructurings, unbundlings, new listings and BEE activity in those heady years. And, true to form, the Three Musketeers grasped the potential of placing an owner-managed Ethos in safe hands and allowing it to chart its own course, keeping RMB’s own pukka private equity units nicely separate. Call it a fortuitous meeting of minds and business cultures.

At the Ethos press launch in March 1999, André suggestively placed a toy cash register on the desk in front of him. I have a hunch that it has rarely stopped ringing regularly since. André is an unfailingly courteous and professional chap, but he was strangely unforthcoming when probed subsequently about the sort of IRRs Ethos was notching up. Yet, just as Rolls Royce never disclosed the power output of its engines - preferring only to say it was “adequate” - it became clear that Ethos was both living up to what, at the time, I said was its “somewhat contrived” name and generating handsome returns.

Of course, André, who is the epitome of that rare species, the quiet South African, is not given to bragging, preferring to remain his unwavering focus on the business case and doing the right thing. He never spoke ill of his competitors, even when I joked that he had set up his shop at the quality end of Johannesburg’s Fricker Road, whose curse famously claimed a few lesser financial services pretenders over the years. He made private equity sound so simple when he said: “What’s important is to pick trends, seize opportunities and buy well. We are certainly not overpayers.”

As a former banker-turned-journalist interloper from London, I valued André’s deep knowledge of what he liked to call the “adolescent” SA market and treasured the way he unselfishly made time to share his rich insights into all things South African. It is as if André’s mission were to raise standards across the whole South African private equity sector, vital as it is to South Africa’s corporate renewal and competitiveness. What’s more, he was ever concerned for my own well-being and professional happiness. A rare species indeed. I hope there will be many more meetings.

André, put simply, you created value from great values. Look back on a lifetime of achievement but don’t hold on to your wisdom. Ethos is in new hands now, but you are still needed - and valued! For proof of that, just look around you!"

Edward Pitsi

Co-founder and CEO of Infinite Partners and formerly Managing Partner of the Ethos Mid Market Fund

"André Roux - A True Stateman of Private Equity In Africa

I joined Ethos Private Equity in February 2011. Prior to joining the firm, my final interview was scheduled towards the backend of November 2010. The final interview was with the man himself.

I was very well prepared to discuss private equity trends, sectors I like, transaction ideas etc. I started going down this track but André very quickly nipped this in the bud. He said, “I suspect you will get an offer from us, I just want to know about you. Who are you? What makes you the person that you are?”. This stands out it marks a golden thread in my relationship with André, he was always interested in me as an individual and was invested in me as a holistic person.

Another feature of André which brings a smile to my face was always how he conducted himself in Investment Committees, he would always drop very insightful “one liners” which made the meeting memorable. On one investment he quipped that the investment proposal was “not a dripping roast”. He would also seek to calibrate the risk return profile of prospective investments by stating that some investments were “sweet dreams” or “straight down the fairway” type investments.

André’s aura was palpable, it really has been a privilege to call him a colleague, boss and mentor.

Salute!"

Richard Fienberg

Formerly Partner: Value Add at Ethos Private Equity

"André has been a critical influence in my life providing both opportunity and wisdom. He catalysed a fundamental career change for me through a process which typified his character and skill. He never rushed the process, rather invested time and conversation in getting to know each other - professionally and personally - building trust, sharing insights and providing guidance; steadily steering the ship towards its destination with a blend of confidence, care, respect and insight. I realised later in my time in Ethos, that these intrinsic qualities combined with his impeccable integrity and attention to detail, set him apart in the industry and indeed in the business community as a whole.

André has never sought the limelight and has carried his considerable success with dignity and humility, always quick to pass on credit to others.

All André's decisions are carefully considered and evaluated - never impetuous. The nature of the industry and indeed success in business, requires a level of risk taking but to do so thoughtfully and with full understanding. André was the first in the industry in SA to invest significantly in operational support and advisory capacity in the firm which was traditionally built around core financial and investment capability. It was not a trivial decision in terms of approach and philosophy and personally I was hugely privileged to be 'invited in' to a world of which I really had very little knowledge and direct experience. The trust and patience he showed and the guidance offered at critical times proved crucial to the evolution of the firm and did influence others in the industry to adopt certain aspects of the approach.

Over the years my wife Maureen and I have spent an increasing amount of time with André and his gracious wife Maureen. Many bottles of good wine have been consumed together over the years and as his health has sadly deteriorated over the last few years, there has never been a word of regret or complaint, only care, gratitude and appreciation of others. We watched the Springboks together as they won the world cup in that nerve tingling match and when asked whether he would like a glass of champagne late on that Saturday night the answer was 'of course'.

In business and in life André has - and continues - to demonstrate not only courage and resilience but care and gratitude to others all the while maintaining a zest for life.

André - thank you...we truly love you.

hillies."

John van Wyk

Formerly Head of Private Equity for Actis, previously Partner at Ethos Private Equity

"When I think about André and the influence he had on me and my career, there are a few words that come to mind. Hard work, discipline, rigour and team. I am sure there are many more, but for me these were the standout virtues. A bit about some of them below:

I joined Firstcorp Capital Investors, which became Ethos Private Equity in 1995 and left in 2004. During the 9 years I worked with André it was clear that he was a very hard worker (and task master!). He was in early and always one of the last to leave. He paid attention to the detail of each transaction and spent many hours with each of his team discussing strategies and approaches designed to deliver the best outcome. He was always prepared. Whether or not he said it out loud, he believed that by being better prepared and more knowledgeable he had the edge and he worked hard to maintain that edge. Each day he would ask his PA to distribute photocopies and cut outs of relevant and interesting information to the team - information that he had sourced from his own research.

I recall delivering a freshly completed investment paper late one evening to his home. “Come whenever it's done” he said “don’t worry if it’s late”. On arrival at around 11pm I guess, his wife Maureen greeted me and ushered me to the living room. There I found André, sitting on the floor with financial journals scattered around him, voraciously assimilating as much information as he could absorb. It was fairly obvious that this was his daily routine. It was no accident that he knew more than most people he encountered on a wide range of topics.

Prior to founding Firstcorp Capital Investors, the predecessor to Ethos, André came from a corporate finance background. He carried those skills into the PE business. Deeply analytical, I believe that one of the great strengths in both Firstcorp Capital and Ethos during the time I was there was the discipline and rigour that went into the analysis of an investment opportunity. Part of the investment process was an extremely thorough financial analysis. To this day, I believe that the processes followed were as good or better than those of many of the PE businesses of today. We used to spend many hours gaining a thorough understanding of past performance as well as why the future presented as it did. In my opinion, one of the biggest mistakes made in valuing businesses from the perspective of the acquirer is that of optimism. As humans our bias is generally towards being too optimistic and as a result a large percentage of businesses don’t hit their forecasts. I would say that because of the internal processes André developed, this was less of a risk.

The success of any business is usually not attributable to one individual, although leadership is a fundamental ingredient. I would say that Ethos and its predecessor Firstcorp Capital are no exception. André selected his team very carefully. He had a sense of what value each individual brought and ensured that as a unit the team was well rounded. It took a fair while to earn his trust. He was strongly of the view that experience mattered in the PE world. I wasn’t as convinced then as I am now, but once again he was right.

As far as milestones go, there were many. The business grew from an investor off the bank’s balance sheet to one of the largest third-party fund managers in South Africa. Ethos was well known internationally and considered by highly reputable investors as a blue-chip investment institution. There were also some very significant PE transactions. Amongst others, Foodcorp, completed in 1998 at an EV of R1.8bn was the largest public to private in SA at the time and this was followed not long afterwards by WACO, another Ethos deal at R 2.4bn. These were very significant transactions in those days.

The other milestone transaction was the creation of Ethos. I was fortunate to be around at its genesis, essentially as a buyout by the management of the Firstcorp Capital business from FirstRand at the time of the creation of FirstRand through the merger of RMB and FNB. This transaction involved risk as a significant amount was borrowed to acquire the bank’s LP share. André saw this opportunity and together with the team built a truly independent world class investor that became one of the most recognisable names in African PE."

Garry Boyd

Former senior executive and founding partner of Ethos Private Equity

"André is a giant of his industry. Many professionals, including me, and this is much much wider than those who worked for Ethos) owe their careers to André. Undoubtedly there is no single individual who has had nearly such wide positive ripple effect throughout the industry be it on other independents, venture versus mature businesses, the “big bank” player, the spectrum of institutional investors, true black economic empowerment, and of course Sanari is a good example of a tribute to both André and Sam.

It should also be strongly recognised that André and his colleagues at Ethos were foundational in establishing a distinct and substantive private equity industry on the African continent. In a sense Ethos joining the Rohatyn Group has brought that contribution and role full circle, and holds the potential to substantially extend the Africa-wide impact.

For me there was and is a very strong moral dimension to André and I attribute the outstanding durability of the Ethos team (through a number of fiery trials over more than 3 decades) primarily to an unwavering integrity including being open to adapting the “human” challenges that involves willingness to adapt and change, always governed first by what is morally right, with commercial and other benefits flowing from that. He exhibits a thirst and drive to break new ground and help others to do that; this is a moral quality.

Dedication, focus and hard work second to none. Astute, bold yet considered.

Always supported the founding and development of SAVCA.

With warmest regards and very best wishes,

Garry"

Samantha Watermeyer

Partner and Head of Operations, Legal and Compliance at Sanari Capital

"André Roux is a remarkable man. His reputation precedes him, and I recall the trepidation with which I approached my early interactions with him. I’d heard so much about who this man was to the industry; the ground he’d broken, the mountains he’d moved. I may have had knowledge and expertise within my own field, but here I was, newly living and breathing private equity, with the doyen himself.

Not once did André ever allow me to feel anything but equal. The attention and interest with which he engaged was unexpected: it didn’t matter that I was new to the industry and lacking experience, my insights and opinions held weight, and he wanted to hear them.

During his time serving on the Sanari board, André wore multiple hats. Somehow, he still managed to find time to share thoughts, articles and opinions of relevance, with me…

Morning Sam, something to keep in mind…

Sam, not sure if you’ve seen this, might become relevant…

Hi Sam, may be of interest, may not…

And this was not unique to me – he did it for many members of our team!

Amongst many other things, André taught me about governance best practices and effective business risk management. More importantly though, André taught me about humility. There is so much value to be gained in sharing knowledge, expertise and experiences with the next generation. It need not matter who you are – how much you’ve accomplished or how much respect and authority you command (and have earned) – you can and should do it. The impact you will have in doing so is immeasurable!

Thank you, André, for your steadfast guidance and support, and for being you. You are one in a million.

Take care.

Sam W"

Cora Fernandez

Formerly Managing Director at Sanlam Investment Management, CEO of Sanlam Private Equity and previously investment professional at Ethos Private Equity

"When I joined Ethos Private Equity in 2000, I was oblivious to the fact that my entry into the asset class was under the astute watchful eye of Mr Private Equity himself, the Father of the Asset Class. I didn’t know what private equity was when I entered that faithful interview with André and Chelsea, nor did I know that my career was about to kick off.

André instilled the highest standards of diligence, attention to detail and scenario planning into the team, under the watchful bight eyed bushy tail of Cora. It was truly remarkable to watch André in meetings, hanging onto every word he said, taking copious notes and pondering over his questions for days on end. I watched André, borderline studied him up to and including his daily lunch sandwich of choice. André is a man of few words, and very deep thinking and a masterful tactician. I was baffled by how much André knew about private equity, both local and international events and trends, until I asked his assistant Colleen what he does in his office all day. She said, he reads the journals and magazines from the Ethos library (this is pre-Google) and articles given to him by Chelsea. I have never been so grateful that my office was so far from André’s office because I was well known in Ethos for being noisy, truth be told, I disturb the peace in the office. Needless to say, I became a regular guest of the Ethos library.

André is a history boffin, and ignited my interest in history, especially economic history. I distinctly remember an investor asking André his views on what was then known as “the small banking crisis” in 2002 when the Financial Mail feature something to the effect of “The death of Fricker Road”, when Fricker Road was the home of small banks. His response was baffling and profound… ”The cream will rise to the top”. Needless to say he called it!

One year Ethos decided to celebrate Halloween in the Ethos bar. The team gathered in the bar in great anticipation, costumes in hand, and André was nowhere to be found. We were then informed that he is still at his desk and this is Friday and well after 17h00. The team made the decision that me and my Jackson five wig and sunglasses should go and get André to come and join the festivities. I enter his office, he raises he hands, thinking he is about to be mugged. It was a sight to behold and extremely funny, bearing in mind that André is not one for foolishness. What I learnt from that experience, after André shared what had happened with the ensuing laughter was that I was chosen for this tricky task because André was unlikely to reprimand me for my folly. André Roux’s impact on my career is unquestionable."

Colin Coleman

Non-executive director, various and Adjunct professor at Columbia Business School, formerly CEO of Goldman Sachs, Sub Saharan Africa

"My heartfelt congratulations to André Roux on his Lifetime Achievement Award. André has defined private equity in South Africa, and if anyone is the King of private equity in SA, he wears that crown. Not only, in my then capacity as Partner and Managing Director of Goldman Sachs in the region, did I find André to be a professional of the highest calibre, but I was always struck by what a gentleman and good friend he was always to me, and everyone who came across his path.

If I had one wish, it would be that all his wisdom and kindness could be the cure for his illness, and gift him many more decades of good health with his loved ones and his family.

Thank you André for the years of friendship and collaboration. And Congratulations!"

Craig Dreyer

Formerly CFO at Ethos Private Equity

"Before becoming the CFO of Ethos Private Equity for 21 years, I was a partner at BDO the accounting and audit firm, when I came into contact with André and the Ethos staff (then FirstCorp Capital Partners) in 1997. I was being interviewed for the CFO position at Ethos. What struck me in the early interview process was the professional and clear manner in which the respective partners conducted themselves, during a rigorous interview process. The values of full accountability and exemplary standards was what impressed me most about the people and the organisation. Despite this, there was an incredibly strong and positive camaraderie amongst the partners which was quite tangible. It was clear to me that this was the organisation that I wanted to join. I had no doubt that Ethos could offer me an outstanding and stimulating working environment, and I joined the organisation in 1998.

Reflecting back, it was André who determined and created the culture and ethos for the firm. During my first investor AGM that I attended in 1998, I remember the simple but powerful message that was conveyed to investors in a presentation, which was the following: “We are extremely grateful and privileged to manage the investor funds that you have placed in our custody and we want to give you the assurance that we take this responsibility extremely seriously.” This simple sentence encapsulated everything that Ethos stood for and it shaped the way the firm conducted itself in every single interaction with its investors. This could be evidenced in investment committee papers motivating a prospective investment, which were drafted to the highest standard, quarterly reports to investors, quarterly reports monitoring portfolio performance, as well as every interpersonal communication that we had with investors. Equally the back-office staff delivered work to the highest level. This is the one and only standard that André required – it was not negotiable.

Moving on through the 21 years where I worked at the firm, the proficiency of skills, ethos and culture remained embedded in the organisation - much to the credit of André, notwithstanding the fact that the firm grew substantially in staff numbers. I should add that working for André was “no walk in the park”. André was a task master of note and demanded extraordinary standards at times. Despite being a strategic operator, André had a scrupulous attention to detail and those of you who knew him then, will know that he did not suffer fools kindly. André was also not a clock watcher himself and he therefore expected his staff to subscribe to the same philosophy. This was just part of the deal – like it or leave it.

André achieved the following measurable milestones:

- In 1985 he established Fund I (balance sheet investments) and completed c52 MBOs. In fact, André largely pioneered MBOs in SA.

- In 1992 he raised the first private equity third part fund.

- In 1996 he raised the first third party fund with international investors.

- Following that, he went on to raise funds up to Fund VI, including a Technology Fund.

The above was no mean feat, considering the context at the time. There is no doubt that André was a giant and leader in the PE industry. Looking back, I feel privileged to work with André and to have been part of the success which he and his Partners built over those 21 years. Thank you!"

Tanya Goncalves (van Lill)

Head of Investor Relations and Impact at Metier, formerly CEO of SAVCA

"Stay true to your roots

Before I met André in 2017 when I took on the role as CEO of SAVCA, I already heard from various sources about this legend who played a pivotal role in shaping the African private equity industry. When you hear so much about someone before you’ve even met them, you start to form an opinion of this person and what they must be like in real life.

To achieve this level of success, I assumed André would be highly intelligent, arrogant, exceptionally tough and full of demands. And that’s what I expected to find when I first met André. Boy oh boy was I wrong. Not about the highly intelligent, but definitely about everything else.

André has this confident but soft demeanour about him. He makes you feel comfortable to share and ask questions without feeling judged. He is sincerely interested in what you have to say. André and I have had many interactions over the years, but the one that stands out for me was at the SAVCA Industry Awards in 2019, where we sat next to each other for the entire evening and mainly spoke about our personal lives.

We both shared stories about where we grew up, where we had gone to school, our interests, our pet hates which were amongst a long list of topics we devoured that evening. The more we spoke, the more comfortable I was sharing my thoughts, feelings, fears and aspirations. André spoke about the importance of staying true to your roots – regardless of the situation or the environment. When André said, “stay true to your roots”, he didn’t mean something literal like where you grew up or went to school – which he said for most people defines them – he meant we should stay connected to our values and beliefs. He said let your values and beliefs guide you in your decision making, in how you treat others and in how you want to be remembered.

André’s words of wisdom have stuck with me and has helped me through many tough situations. He never said it or would admit it, but I surmised from his advice to stay true to your roots is what kept him humble, yet focused and determined throughout his career. This is evident in the admiration that so many have for him, not only because he is successful, but for the person he is – not the person I initially thought I was going to meet."

Sarah E. Alexander

Managing Principal at Private Capital Strategies, faculty lecturer at Johns Hopkins School of Advanced International Studies or formerly the Founding President and CEO of EMPEA (now GPCA)

"I write from Washington, DC, where I spent many a day and hour together with André as we strategized on how to build EMPEA (now GPCA). He lent his wisdom, ear, and support to all our efforts.

I recall with such gratitude and happiness all of our interactions, his support for EMPEA and me personally, and our wonderful conversations all across the globe, including in London and in his offices in Johannesburg.

As I reflect here on how much the world, industry, and our lives have all changed so much since we last spoke, I just want to make sure André knows how important he was and still is in the development of an industry, an association, and a movement.

André, you deserve this lifetime honor, and I am thrilled to be able to be part of this tribute, even if from thousands of miles away.

With respect and gratitude,

Sarah Alexander"

Richard Pender

Consultant and investment committee member at Kleoss, formerly one of the founding partners of Ethos Private Equity

"As one of the founding partners of Ethos, I enjoyed many happy years working with André. I think some of the most memorable were when he and I travelled the world together fund raising shortly after we formed Ethos at the end of the 1990’s. Emerging markets were not exactly the investment flavour of the month at the time, and it was hard going.

However, André’s fortitude, persistence and determination won over, and we ended up raising a substantial fund that was an investment success.

To those in the private equity industry currently enduring the gruelling process of fund raising, take heart – it will always be difficult, but success is attainable to those who stay the course.

Congratulations, André, on your lifetime achievement award – it is richly deserved!

Regards

Richard Pender"

John Bellew

Head of Private Equity at Bowman Gilfillan

"I first met and worked with André in the early 1990s, on a transaction involving Nordberg, a manufacturer of crushing equipment used in the mines. Over the succeeding years I met him often on transactions that Ethos (and its predecessors in title) were working on. Whilst André would not be in the forefront of the negotiations he was always in the background keeping his finger on the pulse and stepping in where required.

I remember his excellent commercial acumen, his ability to home in immediately on key issues and above all his ability to keep channels of communication open.

He always treated people with dignity and respect and never appeared arrogant or overbearing. He was remarkably (for someone who pioneered an industry) free of ego and always put his business first. His professionalism, humility and wisdom were salutary lessons that we all can learn from. I cannot think of a more deserving candidate for this lifetime achievement award."

Moushmi Patel

Partner and co-founder at Sanari Capital

"I do not have the words to express how grateful I am to André for all the time he spent mentoring us over the years, for believing in us, and for walking this journey with us. I treasured every moment.

André, with the help of ChatGPT and a bit of wit, I have written a poem for André:

Mr Chairman

You came into Sanari’s life just in time,

A guiding presence so sublime.

Chairman and Advisor, your roles aligned,

Through highs and lows, your wisdom chimed.

The entrepreneurial journey was long,

You encourage us to be strong.

Through tough days we fought,

Emerging better, with your support.

Your belief in our vision, a constant stream,

Walking alongside us through every dream.

Challenging us through each phase,

Shaping us in countless ways.

For the time you invested, our gratitude is profound,

Among the world's finest, your impact is renowned.

You helped us learn and grow,

Someone we are thankful to know.

Yours truly,

Moushmi Patel"

Niel Wyma

Co-founder of Ambit Partners, where André served as an Advisory Board Member and personal mentor

"Major themes

- Intellectual curiosity

- André has a razor-sharp commercial instinct that does not let much through its filter, but he is intensely curious and intellectually honest.

- When we first introduced him to the concept of Search Funds in 2020, he probed and prodded, asking question after question on the model’s strengths and weaknesses.

- After multiple meetings, he connected the dots with other private investment models he had been exposed to.

- Novelty does not scare or impress him, but his curiosity makes him open to ideas and opportunities that the single-minded would overlook.

- Until his illness made it more difficult for him, we never had as much as a quick coffee meeting with André without him feverishly taking down notes, or him coming prepared with printed materials and his major questions already written down. He has an insatiable appetite for learning new things.

Call to action: as you grow and develop, don’t get set in your ways or consider your ideas as better than anyone else’s – remain curious and seek to learn new things every day.

- Generosity

- André would generously offer his time, networks, and other forms of support, asking for nothing in return. In fact, if we didn’t meet for over 4-5 weeks, he’d reach out asking for a time to connect again.

- While we knew that André was doing us a massive favour by giving us his time and sharing his expertise, he never once made us feel like he was doing us a favour.

- We always felt that André really cared about us and our development, and it felt like he enjoyed being in our company and helping us to work through difficult problems.

- André would show his generosity by arriving on time, being prepared, or by inviting us over to his private home to have a coffee or a few drinks.

- His spirit of generosity always made us feel valued and cared for.

Call to action: realize that doing business is about a lot more than making the numbers work. Connecting with your colleagues or counterparts, and making them feel appreciated and valued goes a long way. Don’t say you care, show that you care.

- Super-connector

- Actively trying to add value to people’s lives, André has the superpower to connect people who may have shared interests and then would just get out of their way.

- After every meeting we’ve had with André, we walked away not just with clarity and new questions and ideas, but also a list of 2-4 people that André wanted to put us in touch with – and then always did.

Call to action: actively try to add value to other people’s lives. Offer the introductions, send the email, and make the phone call to help someone. You’ll be surprised how much comes back your way over time.

- Humility

- While perhaps already evidenced by his intellectual curiosity and generosity mentioned above, André’s humility also showed up in his actions in a few other ways:

- Surround yourself with people better than yourself. André constantly advised us to hire and partner with only the very best people. That the big hires he made over the years always turned out to be the most rewarding and value-creating.

- He did not consider himself as superior to anyone else, and he showed it with his actions.

- While perhaps already evidenced by his intellectual curiosity and generosity mentioned above, André’s humility also showed up in his actions in a few other ways:

Call to action: Surround yourself with the best people you can, and let them challenge and push you. Avoid comfort zones and feeling “at ease”. “Humility has nothing to do with the insecure and inadequate, just like arrogance has nothing to do with greatness.”

- Care

- André taught us to connect as an individual, as a human being, first, and then as a professional.

- André would disarm by generously and openly sharing the stories about his upbringing, about his early career in Canada, and the challenges he faced in building out his first firm.

- Almost every meeting would begin with us talking about how our teammates are doing, how our families are doing, and how we were developing personally. He’d ask questions about where we were staying, and what our families’ plans were for the future. He invited the team, with spouses and children over to his place

Call to action: Just like André did, look around you and seek a few people who could benefit from your advice, networks, and support and help them flourish."

Michael Katz

Chairman at ENSAfrica

"I am privileged to make some personal observations on André Roux on the occasion of the SAVCA Lifetime Achievement Award to him.

I have known André over many decades in a number of capacities. From the time of my first meeting with André, and thereafter for so long as I have known him, I have been struck by his vast knowledge of private equity.

I have always regarded him as the father of private equity in South Africa and as the quintessential expert on the topic. Whenever I had a query on the complexities of private equity, be it on tax or otherwise, André or one of his colleagues was one of my first go-to-persons.

Before dealing with some further personal observations it is important to record some biographical details relating to André. He graduated with a Bachelor of Commerce degree from the University of the Witwatersrand and is a member of the South African Institute of Chartered Accountants and serves on the board of the Emerging Markets Private Equity.

Prior to the establishment of Ethos, André jointly held the positions of Chief Executive of FirstCorp Capital Investors Limited and FirstCorp Merchant Bank. He served on the boards of several portfolio companies associated with the various investment funds advised by Ethos and including Alexander Forbes.

André was the founding partner of Ethos, having established the business in 1984. As chief executive, he had overall responsibility for the firm’s strategic, operating and investment activities. He was widely regarded as a pioneer in the private equity industry in South Africa. In 2014, Stuart MacKenzie succeeded André as Ethos CEO, after which time he became Deputy Chairman and remained on the Investment Committee.

André lectured extensively on the private equity industry to business schools, featured as a speaker at industry conferences and has participated in numerous industry-related symposia.

I also understand that André’s achievements include many firsts, namely the first MBO, some of the initial BEE transactions, raising first third party funds and bringing international capital to local private equity markets. In addition, André supports, and generally mentors advises and backs many new organisations in the industry.

Against a background of considerable achievements and industry first, it is appropriate for me to record some personal observations. Notwithstanding his great achievements I have always found André, in my relationships with him, to be humble, personable and always ready to help. In my capacity as chairman of the Tax Commission, whenever I needed a view on private equity structures I wouldn’t hesitate to ask André who was knowledgeable, helpful and has total integrity.

I much admire André’s considerable achievements and his wonderful character traits and salute him on this outstanding SAVCA Lifetime Achievement Award. It is indeed well merited."

Sandy Olivier

Personal assistant to André Roux

"I have had the privilege of working for André since 2017 when I joined him in his transition from CEO of Ethos Private Equity to Deputy Chairman of the Ethos Board. As we know André was the pioneer in establishing private equity in South Africa. In our working years together we forged a great partnership based on trust and mutual respect. What I have learnt from André over the last 7 years is quite remarkable, being involved in many of his financial activities as well as his family life. André has garnered great respect in the financial world both locally, across Africa and abroad.

I think like very many other people here we thank you for all that you have done so tirelessly for the industry André, for the many young business ventures you have encouraged and shared your expertise with and our wish now André is for your health to stabilise allowing you to better enjoy your well-deserved retirement."

Peter Schmid

Non-executive director and investment committee and advisory committee member for various firms, formerly Global Head of Private Equity at Actis, and previously a partner at Ethos Private Equity

"I had the great privilege of working with André at Ethos for 12 years.

André’s vision of creating a South African premier PE house when PE was an unknown investment concept, together with his leadership skills in creating a great team of PE professionals, culminated in Ethos raising substantial capital from some of the top global investors.

André’s leadership and investment prowess built a top quartile investment house that had a material positive impact on South Africa’s economy.

My time as a Partner at Ethos, working with André and the fantastic team he built, was a highlight in my personal career."

Erika van der Merwe

Investment specialist at Robeco, formerly SAVCA CEO

"André Roux is a man of excellence. I know this not so much because of my personal interaction with him -- although his sharply informed and yet warm conversation usually confirmed this -- but because of the many encounters I had with Ethos team members during the time I served at SAVCA.

If someone from Ethos was involved in a discussion amongst members about a regulatory matter, in the sharing of thought leadership for an industry publication, a critical decision at a SAVCA board meeting, or even the preparation of a tea tray for a committee meeting hosted at the Ethos offices, the Ethos way of work always shone through. It meant total commitment to the task at hand, and a clear sense of responsibility to the community.

It was clear to me, therefore, that André required excellence of his team. And I believe he did this in a way that set a standard for the private equity industry in Southern Africa.

This example also meant a great deal to me personally.

Thank you, André."

Arshad Essa

Head of Private Equity at Nedbank

"I wanted to share some of the things that I learnt while working under the leadership of Andre Roux. One of the most valuable lessons I learned was the importance of thoroughly researching and analysing potential investments before committing to them. Additionally, I also learned from Andre that listening to views from all people, regardless of their role in the organization, is a key ingredient to a good investment decision.

I am grateful for the opportunities that Andre opened to me and it is through these opportunities that I have grown professionally and personally. Well done on your award Andre - your impact on me has truly been immense!"

Vuyo Ntoi

Co-Managing Director of African Infrastructure Investment Managers and current Chairman of SAVCA

"Ladies and gentlemen, members and friends of SAVCA

Today, we gather to honour Mr. André Roux with the inaugural André Roux Lifetime Achievement Award.

Let us delve into why recognizing our industry veterans is crucial:

- Preserving Our Collective Legacy: Our veterans are the guardians of wisdom and legacy. They hold the keys to decades of experience. By honouring them, we safeguard our industry’s rich history and ensure that the lessons learned continue to guide us.

- Mentorship and Continuity: Veterans play a pivotal role in fostering mentorship. They pass down their knowledge to the next generation. Recognizing them ensures seamless knowledge transfer, allowing us to build upon their foundation.

- Upholding Ethical Standards: Veterans exemplify integrity. Their ethical conduct sets the bar for all of us. By acknowledging their contributions, we reinforce the importance of ethical practices within our industry.

- Inspiring Adaptability: Our veterans have weathered storms and demonstrated remarkable resilience. Their ability to adapt in turbulent times inspires us all. By celebrating them, we infuse our industry with the spirit of adaptability.

- Unity and Gratitude: Recognition unites us. We express gratitude for the giants whose shoulders we stand upon. Their dedication and vision have shaped our industry, and we honor their legacy.

South Africa’s private equity industry holds a unique position globally. It was an early pioneer in the establishment of the asset class.

This early start has given rise to a deep and mature market, providing a solid foundation for growth and innovation.

Moreover, many of our current industry leaders cut their teeth in institutions established by André Roux and his peers.

Their collective expertise forms the bedrock from which we continue to build and evolve. By looking to our past, we gain insights into the future.

So, let us celebrate André Roux’s indelible mark on our industry. May his influence continue to ripple through generations, inspiring us to reach greater heights.

Thank you, André Roux, for your enduring legacy."

Thiru Pather

Investment Principal, the SA SME Fund Limited

"I've been fortunate to know and work with Andre for many years, in two different capacities - my role at the PIC when the organisation invested in one of the Ethos buyout funds, and more recently my role at the SA SME Fund where Andre served on our Investment Committee.

Andre has always been a gentleman - treating everyone with the utmost respect. Andre had the ability to cut through to the crux of issues in transactions, raising these issues with the utmost pragmatism.

It has been a pleasure working with Andre. An award well deserved!"

David Stadler

Formerly head of Nedbank Private Equity and chair of SAVCA

"Andre Roux was undoubtedly the private equity industry leader in Southern Africa. This was not only evidenced by the firm he formed and led and the top-class teams that he built and maintained, but by his integrity and the respect that he commanded.

Andre set the benchmark for the industry in Southern Africa and the standards to which many in the industry espoused. He struck me as quiet, attentive in discussions, steely determined and fair, with a keen interest in the development and support of the private equity industry.

This was more manifest to me during my tenure as chairperson of SAVCA as he encouraged the growth and strength of the industry body. Andre was also instrumental in my invitation from the Emerging Markets Private Equity Association ("EMPEA" – now Global Private Capital Association) to join it's Africa Council.

Andre is held in high esteem internationally, not only as a board member of EMPEA, but as chair of the Africa Council and as a private equity industry leader in Africa. I recall at an international conference in London, David Rubenstein, then CEO of Carlyle Group, pronouncing on a public platform that, after a dinner he had enjoyed with Andre the previous evening, the place to invest was in South Africa!

Andre has achieved an exemplary track record – his achievements are top ranked.

I am thrilled that Andre has received SAVCA's first lifetime achievement award. Without doubt, he is deserving of it. My congratulations to him!

Warm regards

Dave Stadler"

Herman Bosman

Atelier Partners, CEO at RMB and RMI

"Over the last 3 decades, I had the pleasure of working with Andre Roux in different capacities, including as advisor, counterparty and fellow board member.

In all of our interactions, consistently and without fail, Andre provided such poignant, considered and insightful views – and always in such a dignified way. He distilled problem sets into clear and concise discussion points and always offered a balanced view.

On a wider level, Andre was the pioneer of South African private equity and established an industry, a firm and many proteges which he can truly be very proud of."

Stories & reflections from the industry

Paul Boynton

Formerly CEO of Old Mutual Alternative Investments

"André was a seminal figure in the development of the private equity industry in South Africa. He was there at the beginning in the early 1980’s, played a massive role in the development of arguably the premier shop in town and had many folk graduate through the ranks at Firstcorp or Ethos who subsequently went on to write chapters of their own in the history-books of private equity in South Africa."

Richard Stovin-Bradford

Former journalist at Business Report, Sunday Times Business Times and Lex columnist at the Financial Times, London.

"André Roux set a high bar for South Africa’s nascent private equity sector at First Corp Capital Investors, which was the country’s largest alternative capital provider at the time. Time flies: it started life in the First National Bank stable forty years ago. And when, in late 1998, André led its transformation into an independent, management-owned and operated business, relaunching it under the Ethos Private Equity banner, he raised that bar."

Edward Pitsi

Co-founder and CEO of Infinite Partners and formerly Managing Partner of the Ethos Mid Market Fund

"André Roux - A True Stateman of Private Equity In Africa

I joined Ethos Private Equity in February 2011. Prior to joining the firm, my final interview was scheduled towards the backend of November 2010. The final interview was with the man himself."

Richard Fienberg

Formerly Partner: Value Add at Ethos Private Equity

"André has been a critical influence in my life providing both opportunity and wisdom. He catalysed a fundamental career change for me through a process which typified his character and skill. He never rushed the process, rather invested time and conversation in getting to know each other - professionally and personally - building trust, sharing insights and providing guidance; steadily steering the ship towards its destination with a blend of confidence, care, respect and insight."

John van Wyk

Formerly Head of Private Equity for Actis, previously Partner at Ethos Private Equity

"When I think about André and the influence he had on me and my career, there are a few words that come to mind. Hard work, discipline, rigour and team. I am sure there are many more, but for me these were the standout virtues. A bit about some of them below:"

Garry Boyd

Former senior executive and founding partner of Ethos Private Equity

"André is a giant of his industry. Many professionals, including me, and this is much much wider than those who worked for Ethos) owe their careers to André. Undoubtedly there is no single individual who has had nearly such wide positive ripple effect throughout the industry be it on other independents, venture versus mature businesses, the “big bank” player, the spectrum of institutional investors, true black economic empowerment, and of course Sanari is a good example of a tribute to both André and Sam."

Samantha Watermeyer

Partner and Head of Operations, Legal and Compliance at Sanari Capital

"André Roux is a remarkable man. His reputation precedes him, and I recall the trepidation with which I approached my early interactions with him. I’d heard so much about who this man was to the industry; the ground he’d broken, the mountains he’d moved. I may have had knowledge and expertise within my own field, but here I was, newly living and breathing private equity, with the doyen himself."

Cora Fernandez

Formerly Managing Director at Sanlam Investment Management, CEO of Sanlam Private Equity and previously investment professional at Ethos Private Equity

"When I joined Ethos Private Equity in 2000, I was oblivious to the fact that my entry into the asset class was under the astute watchful eye of Mr Private Equity himself, the Father of the Asset Class. I didn’t know what private equity was when I entered that faithful interview with André and Chelsea, nor did I know that my career was about to kick off."

Colin Coleman

Non-executive director, various and Adjunct professor at Columbia Business School, formerly CEO of Goldman Sachs, Sub Saharan Africa

"My heartfelt congratulations to André Roux on his Lifetime Achievement Award. André has defined private equity in South Africa, and if anyone is the King of private equity in SA, he wears that crown. Not only, in my then capacity as Partner and Managing Director of Goldman Sachs in the region, did I find André to be a professional of the highest calibre, but I was always struck by what a gentleman and good friend he was always to me, and everyone who came across his path."

Craig Dreyer

Formerly CFO at Ethos Private Equity

"Before becoming the CFO of Ethos Private Equity for 21 years, I was a partner at BDO the accounting and audit firm, when I came into contact with André and the Ethos staff (then FirstCorp Capital Partners) in 1997. I was being interviewed for the CFO position at Ethos. What struck me in the early interview process was the professional and clear manner in which the respective partners conducted themselves, during a rigorous interview process. The values of full accountability and exemplary standards was what impressed me most about the people and the organisation."

Tanya Goncalves (van Lill)

Head of Investor Relations and Impact at Metier, formerly CEO of SAVCA

"Stay true to your roots

Before I met André in 2017 when I took on the role as CEO of SAVCA, I already heard from various sources about this legend who played a pivotal role in shaping the African private equity industry. When you hear so much about someone before you’ve even met them, you start to form an opinion of this person and what they must be like in real life."

Sarah E. Alexander

Managing Principal at Private Capital Strategies, faculty lecturer at Johns Hopkins School of Advanced International Studies or formerly the Founding President and CEO of EMPEA (now GPCA)

"I write from Washington, DC, where I spent many a day and hour together with André as we strategized on how to build EMPEA (now GPCA). He lent his wisdom, ear, and support to all our efforts."

Richard Pender

Consultant and investment committee member at Kleoss, formerly one of the founding partners of Ethos Private Equity

"As one of the founding partners of Ethos, I enjoyed many happy years working with André. I think some of the most memorable were when he and I travelled the world together fund raising shortly after we formed Ethos at the end of the 1990’s. Emerging markets were not exactly the investment flavour of the month at the time, and it was hard going."

John Bellew

Head of Private Equity at Bowman Gilfillan

"I first met and worked with André in the early 1990s, on a transaction involving Nordberg, a manufacturer of crushing equipment used in the mines. Over the succeeding years I met him often on transactions that Ethos (and its predecessors in title) were working on. Whilst André would not be in the forefront of the negotiations he was always in the background keeping his finger on the pulse and stepping in where required."

Moushmi Patel

Partner and co-founder at Sanari Capital

"I do not have the words to express how grateful I am to André for all the time he spent mentoring us over the years, for believing in us, and for walking this journey with us. I treasured every moment.

André, with the help of ChatGPT and a bit of wit, I have written a poem for André:"

Niel Wyma

Co-founder of Ambit Partners, where André served as an Advisory Board Member and personal mentor

"Major themes"

Michael Katz

Chairman at ENSAfrica

"I am privileged to make some personal observations on André Roux on the occasion of the SAVCA Lifetime Achievement Award to him.

I have known André over many decades in a number of capacities. From the time of my first meeting with André, and thereafter for so long as I have known him, I have been struck by his vast knowledge of private equity."

Sandy Olivier

Personal assistant to André Roux

I have had the privilege of working for André since 2017 when I joined him in his transition from CEO of Ethos Private Equity to Deputy Chairman of the Ethos Board. As we know André was the pioneer in establishing private equity in South Africa. In our working years together we forged a great partnership based on trust and mutual respect. What I have learnt from André over the last 7 years is quite remarkable, being involved in many of his financial activities as well as his family life. André has garnered great respect in the financial world both locally, across Africa and abroad.

Peter Schmid

Non-executive director and investment committee and advisory committee member for various firms, formerly Global Head of Private Equity at Actis, and previously a partner at Ethos Private Equity

"I had the great privilege of working with André at Ethos for 12 years.

André’s vision of creating a South African premier PE house when PE was an unknown investment concept, together with his leadership skills in creating a great team of PE professionals, culminated in Ethos raising substantial capital from some of the top global investors."

Erika van der Merwe

Investment specialist at Robeco, formerly SAVCA CEO

"André Roux is a man of excellence. I know this not so much because of my personal interaction with him -- although his sharply informed and yet warm conversation usually confirmed this -- but because of the many encounters I had with Ethos team members during the time I served at SAVCA."

Arshad Essa

Head of Private Equity at Nedbank

I wanted to share some of the things that I learnt while working under the leadership of Andre Roux. One of the most valuable lessons I learned was the importance of thoroughly researching and analysing potential investments before committing to them. Additionally, I also learned from Andre that listening to views from all people, regardless of their role in the organization, is a key ingredient to a good investment decision.

Vuyo Ntoi

Co-Managing Director of African Infrastructure Investment Managers and current Chairman of SAVCA

"Ladies and gentlemen, members and friends of SAVCA

Today, we gather to honour Mr. André Roux with the inaugural André Roux Lifetime Achievement Award.

David Stadler

Formerly head of Nedbank Private Equity and chair of SAVCA

"Andre Roux was undoubtedly the private equity industry leader in Southern Africa. This was not only evidenced by the firm he formed and led and the top-class teams that he built and maintained, but by his integrity and the respect that he commanded.

Andre set the benchmark for the industry in Southern Africa and the standards to which many in the industry espoused. He struck me as quiet, attentive in discussions, steely determined and fair, with a keen interest in the development and support of the private equity industry. "

Herman Bosman

Atelier Partners, CEO at RMB and RMI

"Over the last 3 decades, I had the pleasure of working with Andre Roux in different capacities, including as advisor, counterparty and fellow board member."

Ethos (now The Rohatyn Group)

Formerly Brait Private Equity

Yellow Spot, formerly McKinsey

Sanari Capital, formerly Ethos

Phatisa, formerly Ethos

DEG

Formerly Ethos Private Equity

DataDiligence, formerly Ethos

Sphere Private Equity

Founder of Hamilton Lane

Sanari Capital

Ethos (now The Rohatyn Group)

Formerly Brait Private Equity

Yellow Spot, formerly McKinsey

Sanari Capital, formerly Ethos

Phatisa, formerly Ethos

DEG

Formerly Ethos Private Equity

DataDiligence, formerly Ethos

Sphere Private Equity

Founder of Hamilton Lane

Sanari Capital

Lessons learnt from André

"He made private equity sound so simple when he said: “What’s important is to pick trends, seize opportunities and buy well. We are certainly not overpayers.”"

- Richard Stovin-Bradford

"André has deep conversations and is insatiably curious. Always asking follow-up questions at least one level deeper than others have gone. He exemplified the strategy of turning the box over in every conceivable way to ensure the optimal outcome but what also impressed was the thought given to ensuring it worked for everyone. An example for all of us as someone who has passionately developed the whole industry around them whilst also personally building an exceptional position within it."

- Paul Boynton

"On team and portfolio construction: “Never mix ice cream and manure – you end up with only one thing that tastes like sh*t.”"

- Niel Wyma

"All André's decisions are carefully considered and evaluated - never impetuous. The nature of the industry and indeed success in business, requires a level of risk taking but to do so thoughtfully and with full understanding."

- Richard Fienberg

"Deeply analytical, I believe that one of the great strengths in both FirstCorp Capital and Ethos during the time I was there was the discipline and rigour that went into the analysis of an investment opportunity. To this day, I believe that the processes followed were as good or better than those of many of the PE businesses of today. In my opinion, one of the biggest mistakes made in valuing businesses from the perspective of the acquirer is that of optimism. As humans our bias is generally towards being too optimistic and as a result a large percentage of businesses don’t hit their forecasts. I would say that because of the internal processes André developed, this was less of a risk."

- John van Wyk

"Deeply analytical, I believe that one of the great strengths in both FirstCorp Capital and Ethos during the time I was there was the discipline and rigour that went into the analysis of an investment opportunity. To this day, I believe that the processes followed were as good or better than those of many of the PE businesses of today. In my opinion, one of the biggest mistakes made in valuing businesses from the perspective of the acquirer is that of optimism. As humans our bias is generally towards being too optimistic and as a result a large percentage of businesses don’t hit their forecasts. I would say that because of the internal processes André developed, this was less of a risk."

- John van Wyk

"For me there was and is a very strong moral dimension to André and I attribute the outstanding durability of the Ethos team primarily to an unwavering integrity including being open to adapting the “human” challenges that involves willingness to adapt and change, always governed first by what is morally right, with commercial and other benefits flowing from that."

- Garry Boyd

"Amongst many other things, André taught me about governance best practices and effective business risk management. But more importantly though, André taught me about humility. There is so much value to be gained in sharing knowledge, expertise and experiences with the next generation."

- Sam Watermeyer

"I was baffled by how much André knew about private equity, both local and international events and trends, until I asked his assistant Colleen what he does in his office all day. She said, he reads the journals and magazines from the Ethos library (this is pre-Google) and articles given to him by Chelsea. I have never been so grateful that my office was so far from André’s office because I was well known in Ethos for being noisy. Needless to say, I became a regular guest of the Ethos library."

- Cora Fernandez

"I distinctly remember an investor asking André his views on what was then known as “the small banking crisis” in 2002 when the Financial Mail feature something to the effect of “The death of Fricker Road”, when Fricker Road was the home of small banks. His response was baffling and profound… “The cream will rise to the top”. Needless to say he called it!"

- Cora Fernandez

"During my first investor AGM that I attended in 1998, I remember the simple but powerful message that was conveyed to investors in a presentation, which was the following: “We are extremely grateful and privileged to manage the investor funds that you have placed in our custody and we want to give you the assurance that we take this responsibility extremely seriously.” This simple sentence encapsulated everything that Ethos stood for and it shaped the way the firm conducted itself in every single interaction with its investors."

- Craig Dreyer

"Finding your angle and why you will win is important for investment success in private equity. Seeking out solutions and active management are important drivers. But André also cautioned against trying to solve too many problems and the importance of saying no, and simplifying."

- Samantha Pokroy

"André spoke about the importance of staying true to your roots – regardless of the situation or the environment. When André said, “stay true to your roots”, he didn’t mean something literal like where you grew up or went to school – which he said for most people defines them – he meant we should stay connected to our values and beliefs. He said let your values and beliefs guide you in your decision making, in how you treat others and in how you want to be remembered."

- Tanya Goncalves (van Lill)

"To those in the private equity industry currently enduring the gruelling process of fund raising, take heart – it will always be difficult, but success is attainable to those who stay the course."

- Richard Pender

"He always treated people with dignity and respect and never appeared arrogant or overbearing. He was remarkably (for someone who pioneered an industry) free of ego and always put his business first. His professionalism, humility and wisdom were salutary lessons that we all can learn from."

- John Bellew

"Novelty does not scare or impress him, but his curiosity makes him open to ideas and opportunities that the single-minded would overlook. I learnt that as you grow and develop, don’t get set in your ways or consider your ideas as better than anyone else’s – remain curious and seek to learn new things every day."

- Niel Wyma

"Surround yourself with the best people you can and let them challenge and push you. Avoid comfort zones and feeling “at ease”. “Humility has nothing to do with the insecure and inadequate, just like arrogance has nothing to do with greatness.”"

- Niel Wyma

"I also learned from Andre that listening to views from all people, regardless of their role in the organization, is a key ingredient to a good investment decision."

- Arshad Essa