MEDIA RELEASE: WHY A SIMPLE REG 28 AMENDMENT COULD FUEL SA’S ECONOMIC RECOVERY

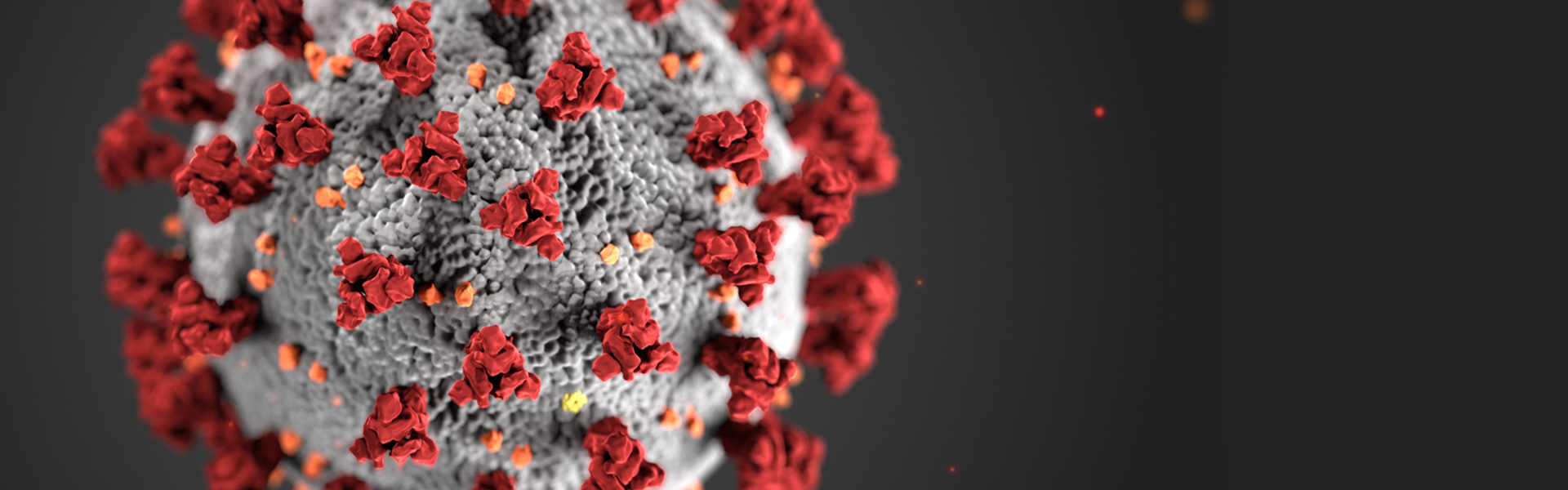

COVID-19 and the ensuing national lockdown has had a dramatic effect on all spheres of South African society, but small and medium-sized enterprises (SMEs) – especially those in the service sector – have been particularly hard hit. These SMEs, however, are also the fastest creators of new jobs, and could underpin the country’s much-needed economic…

Read MoreMEDIA RELEASE| SAVCA APPOINTS TWO NEW BOARD MEMBERS

The Southern African Venture Capital and Private Equity Association (SAVCA) – the industry body for private equity and venture capital in Southern Africa –welcomes two new directors to its board, following the virtual SAVCA Annual General Meeting (AGM) held on 7 October 2020. SAVCA CEO, Tanya van Lill says that the new appointees – Natalie…

Read MorePRESS RELEASE| Vantage Capital invests $28.0 million in CIM Santé Group

Casablanca, Morocco – Vantage Capital, Africa’s largest mezzanine fund manager, announced today that it has made a $28.0 million equity investment to acquire a significant minority shareholding in the Cliniques Internationales du Maroc Group (“CIM Santé Group”). The business was founded in 1994 by Professor Assad Chaara, an internationally renowned cardiologist who pioneered coronary angiography…

Read MorePRESS RELEASE| Championing economic opportunities for women in Africa – Development Partners International’s (DPI) latest fund to become the first 2X Flagship Fund

DPI’s African Development Partners III Fund (“ADP III”) has been chosen as the first 2X Flagship Fund, committed to investing with a gender lens. DPI’s long-standing commitment to gender equity, along with its fund’s commercial performance, recognises the power of DFI collaboration working alongside proactive fund managers to effect real development impact while generating commercial…

Read MorePRESS RELEASE | RECORD EXIT ACTIVITY REPORTED BY VC FUND MANAGERS IN SA

While South African venture capital (VC) investors may have seen a significant slowdown in deal activity this year as a result of COVID-19, the local VC landscape experienced record investment and exit activity in 2019. This is according to the newly released SAVCA 2020 Venture Capital Industry Survey, which shows that a total of 38…

Read MorePRESS RELEASE| PAPE FUND 3 ACQUIRES 45% EQUITY IN THE DDS GROUP OF COMPANIES

PAPE Fund 3, the mid-cap South African private equity fund has announced the successful acquisition of 45% of the equity in the DDS Group of companies, a leading African beverage dispensing and refrigeration services provider. The DDS Group of companies provide beverage dispensing and refrigeration services on behalf of the multinational distributors, as illustrated by…

Read MorePRESS RELEASE: SA Private Equity takes a knock but will rally

The latest RisCura-SAVCA South African Private Equity Performance report reveals that private equity, like many asset classes, couldn’t quite escape the impact of COVID-19. The 2020 first quarter report tracks a representative basket of private equity funds in South Africa. Monwabisi Zikolo, a senior private equity analyst at investment firm RisCura, says that South African…

Read MorePRESS RELEASE| Rack Centre announces $100m expansion to create West Africa’s largest data centre.

LAGOS, NIGERIA, 31 August 2020 – Rack Centre, the leading carrier neutral data centre operator in West Africa, has announced an expansion programme that will increase capacity to a total net lettable white space of 6000 square metres and allow for 13MW of IT power capacity in its Lagos campus. This will be in addition…

Read MorePrivate Equity in Southern Africa: 7 takeaways from SAVCA’s latest survey

The Southern African Venture Capital and Private Equity Association (SAVCA) published its 2020 Private Equity Industry Survey, which provides insights into the activities and trends in the Southern African private equity industry for the 2019 calendar year. Here are the main takeaways from the survey. Investment activity 1. Decline in overall dealmaking. The value of…

Read MoreINVESTMENT ANNOUNCEMENT| SANARI CAPITAL BACKS LIGHTWARE LIDAR GLOBAL EXPANSION

Sanari Capital, backed by leading institutional investor 27four, is pleased to announce its R25 million (USD 1.5 million) investment in LightWare LiDAR, a South African company supplying world-class microLiDAR sensor technology to leading global companies. Established in 2012, LightWare gives ‘eyes to machines’, designing and manufacturing the world’s smallest and lightest precision LiDAR systems for…

Read MorePRESS RELEASE| SA PRIVATE EQUITY REMAINS FAVOURABLE RELATIVE TO LISTED MARKET

The latest RisCura-SAVCA South African Private Equity Performance Report reveals that the country’s private equity industry has again outperformed listed equity over the medium-term, as of December 2019. The 2019 fourth quarter report, which tracks a representative basket of private equity funds in South Africa, shows outperformance across all three listed benchmarks over the five-year…

Read MorePRESS RELEASE| PRIVATE EQUITY INDUSTRY WELL POSITIONED TO NAVIGATE COVID-19 CRISIS

After experiencing accelerated growth for the last three years, Sub-Saharan Africa is expected to go deep into contractionary territory in 2020. Highlights from the SAVCA 2020 Private Equity Industry Survey, however, indicate that the private equity industry remained resilient in the face of weak macroeconomic circumstances during the 2019 calendar year, which bodes well for…

Read MorePRESS RELEASE: Meet Thuso, the company transforming the face of South African private markets

Cape Town, July 2020 — When it comes to transformation in South African business, doing things the way they’ve always been done simply isn’t tenable. New approaches are needed. That’s what makes Thuso, a ground-breaking incubation platform in the South African asset management space, so exciting. And with South Africa’s already strained economic and social…

Read MorePRESS RELEASE: COVID-19 RELIEF SHOULD REACH SMEs

Private equity industry asks Government to ensure COVID-19 Guarantee Scheme gets relief and stimulus to where it is needed most. Many small and medium-sized enterprises (SMEs) breathed a brief sigh of relief in April, when President Cyril Ramaphosa announced a R200 billion Government COVID-19 loan guarantee scheme intended to support businesses with an annual turnover…

Read MorePRESS RELEASE: Sanlam launches urgent job-preservation initiative in response to COVID-19

Sanlam Investments is responding to the COVID-19 pandemic through large-scale support of the recovery of South African companies, from small enterprises to corporates that employ a large number of people. Sanlam has committed R2.25 billion of its own capital to seed three funds with the core objective of preserving and creating jobs ̶ in a…

Read MorePRESS RELEASE: Mergence Investment Managers and Third Way Investment Partners in R450-mIllion renewable energy deal

Two established, women-led black fund managers point the way for cleaner energy post-COVID Mergence Investment Managers and Third Way Investment Partners have invested R225m each to refinance a major renewable energy plant in a remote area of South Africa. The project cannot yet be named for confidentiality reasons. Both parties to the transaction have strong…

Read MorePRESS RELEASE: Tana Africa Capital acquires a minority investment into Mabaret Al Asafra, a leading healthcare group in Egypt

Tana Africa Capital (“Tana”), a leading Pan-African private equity firm, is pleased to announce the latest investment through its second fund Tana Africa Capital II (“TAC II”) into Mabaret Al Asafra (“Mabaret”) a leading hospital operator in Alexandria, Egypt. The investment was made directly into Alexandria for Healthcare Investments (“AHI”), that owns the majority stake…

Read MorePRESS RELEASE: SAVCA CALLS FOR REGULATION 28 AMENDMENTS TO SUPPORT SA’s ECONOMIC RECOVERY

Private equity and venture capital funds (‘private equity’) play a unique function in the investment marketplace because they are actively involved in growing companies and their workforces. This differentiates private equity from hedge funds, collective investment schemes and other institutional investors, which generally play no active role in the strategic growth of companies. Despite this…

Read MorePRESS RELEASE: Vantage Capital exits Vumatel

Johannesburg, South Africa – Vantage Capital, Africa’s largest mezzanine debt fund manager, announced that it has fully exited its investment in Vumatel, the largest fibre-to-the-home network provider in South Africa. The company was established in October 2014 by Niel Schoeman and Johan Pretorius, industry veterans who had previously started up the Birchman Group and Conduct…

Read MorePRESS RELEASE: PHATISA AND PARTNERS ACQUIRE SOUTHERN AFRICAN AGRICULTURAL SOLUTIONS PROVIDER FES

22 April 2020 Phatisa Food Fund 2 (PFF 2) and a group of co-investors – Norfund, Mbuyu Capital and DEG – have acquired integrated agricultural solutions provider Farming and Engineering Services Limited (FES). The investment will support FES’s long term growth strategy, assisting the company to expand its successful business model to neighbouring countries. FES,…

Read More